A Carpe Diem Attitude

Thursday, October 16, 2025

Written by Nathan Polackwich, CFA

Categories: General Markets and Economy

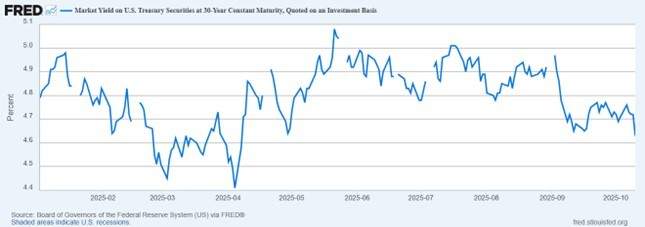

The economy, outside of AI infrastructure spending, isn’t looking too hot. Gasoline prices – a strong indicator of both consumer activity and industrial demand – are down 10% in the last six weeks and more than 20% since late June. Another sign of future growth woes is that despite dollar weakness, surging budget deficits, and a boom in precious metals prices, the 30 year U.S. Treasury rate has actually been falling for a number of months and is now below where it started the year.

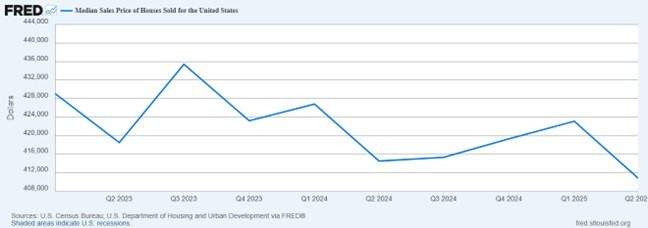

The real estate market has also been weak.

Since the unprecedented (global) fiscal and monetary stimulus in response to COVID – which led to the demand for goods and services exceeding the available supply – economies have experienced rising inflation and interest rates. The problem now, if lower gas prices, home prices, and long term interest rates are any indication, appears to be the opposite – too little demand – again, outside of the AI infrastructure buildout.

So here’s the paradox. In a weakening economy, soaring precious metals prices would typically only occur as a result of investor fear, not optimism. And yet the bubbly AI economy has boosted tech valuations by trillions on practically nothing but extraordinary optimism, as AI related revenues have so far been relatively modest and profits nonexistent.

It looks to me, then, that while the core U.S. (and actually entire international developed) economy is weakening, investors are increasingly trying to make up the difference by putting their money into wildly speculative positions – the more risk and potential return the better. There may also be an element of people fearing (unwarranted in our opinion) the ultimate impact of AI technology on the future job market and accordingly taking risks with a sort of carpe diem attitude.

In any event the result has been an explosion of what is effectively gambling on crypto and anything AI related (lack of profits doesn’t matter) with everyone trying to make a quick buck and presumably exit before the music stops. Soaring precious metals prices – as inflation continues to moderate post COVID – look to have been caught in this same speculative fervor. The following Wall Street Journal headlines, for instance, are something you typically see at market peaks rather than bottoms:

The second article noted that 37% of 25-year-olds used investment accounts in 2024, up from 6% of the age group in 2015. Rather than a positive, I view it as a troubling sign that young people increasingly think the best way to get ahead is to speculate on AI stocks and crypto rather than save for a home or invest in a business. And they’re piling in at a time when tech stocks’ recent outperformance has been even more dominant than during the Internet bubble.

A great deal of money will be lost if the AI wave doesn’t pan out as successfully as the Internet. And even if it does achieve similar importance, there’s still no guarantee tech stocks will continue to rise indefinitely. The Internet was one of the most important technological leaps in history, yet the stock bubble it produced still popped, with the NASDAQ falling 78% from March of 2000 to October 2022.